How much will it cost to enter an aged care home?

Beth Hourigan, social commentator and Director, Aged Care Adviser Network and Financial Services, is frequently asked about the costs of residing in an aged care home. Here she gives a basic overview of what the costs are, how aged care fees work and who pays.

The Australian Government pays for some of the services provided in aged care homes by way of subsidies for each resident, paid directly to the aged care home, but you’ll also contribute to the cost of your care.

How much you do pay (in addition to the standard Daily Care Fee that everyone pays), is means tested. And there could also be Additional or Extra Services Fees if you are intending to enter a home with those options.

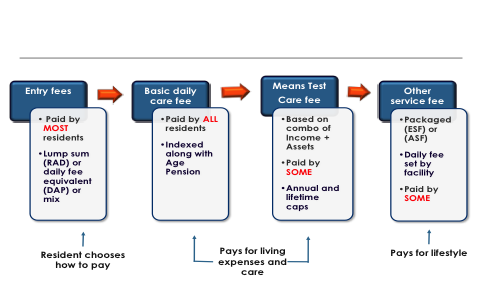

The Australian Government regulates the maximum costs you’ll pay, and homes are required to publish fees on the government’s website, on their own website and in their promotional materials. The following is a simple diagram of the fees and who pays:

Entry Fee – Refundable Accommodation Deposit. This is a lump sum payable to the home for use of the room and they are Fully Refundable on exit and Government Guaranteed.

Residents have 28 days after moving in to decide if they will pay a lump sum, or a Daily Accommodation Payment (interest), or combo of both. There are stringent rules about how the home can use this money and when and how it is to be refunded with the resident exits the home.

Basic Daily Care Fee – is a daily fee used to contribute towards your day-to-day living costs such as meals, cleaning, laundry, heating and cooling. Everyone entering an aged care home is asked to pay this fee. The Basic Daily Care Fee for ALL residents (including respite) is close to 85% of the single Age Pension.

The Basic Daily Care Fee is indexed on 20 March and 20 September each year in line with increases to the Age Pension and you’ll be notified of the change.

Means Tested Care Fee – is an additional contribution towards the cost of care that some people pay based on their income and assets. Centrelink will determine if you are required to pay this fee based on the results of the assessment of your Income and Assets. You’re required to complete an Income and Asset Assessment Form prior to entering a home, however if you chose not to complete the assessment, you’ll be charged at the maximum rate. Some homes charge an interim MTCF until they receive official notice from Centrelink.

It’s worth noting that if you’re a member of a couple, half of your combined income and assets are considered in determining your MTCF regardless of which partner earns the income, or owns the asset.

There are annual and lifetime caps that apply to this fee, and once these caps are reached, you cannot be asked to pay any more means-tested care fees. Any Income Tested Care Fees paid toward Home Care Packages prior to moving into residential care will also contribute toward your annual and lifetime caps.

Other Service Fees – Extra or Additional Services. Additional fees may apply if you choose a higher standard of accommodation, or extra, or additional services. These vary between aged care providers, and the home can give you details of these services. Services may include things like hairdressing and Foxtel.

Financial advice – You may want to consult with a specialist financial adviser about which of these fees apply to you, and how to structure your finances when going into an aged care home. It’s a good idea to do some research and to get professional advice from an experienced aged care specialist to see what options work best for you, and the likely effect of your decisions on your care and your estate wishes.